AI stocks have been the market’s go-to trade for over a year.

From Nvidia’s monster $4 trillion milestone to Tesla’s explosive AI announcements, Wall Street can’t seem to get enough. Even laggards like AMD and IBM are riding the wave.

But here’s the question smart money is starting to ask: Is this just the beginning of the AI era, or are we staring at the next dot-com-style bubble?

When a narrative gets too loud and price action gets parabolic, it’s time to separate hype from reality.

Let’s break down the bull case, the bubble fears, and the signals every trader should watch right now.

AI Stocks Hype Is Real

Let’s be clear: this isn’t a meme bubble. AI isn’t just storytelling and stock pumping. Real money is flowing.

Big Tech is spending billions on chips, data centers, and hiring engineers like it’s 1999. Nvidia alone booked over $26 billion in data center revenue last quarter, up triple digits year-on-year.

This is a legit demand. Microsoft is rolling out AI copilots across its product suite. Google’s quietly integrating AI into search, ads, and cloud. Meta’s building its own LLMs. Even Apple finally joined the party, hinting at deeper AI integrations across iOS.

So no, this isn’t just vapor. The cash flows are real. The question isn’t if AI is changing the game. The question is how much of that future is already priced in?

Are AI Stocks Already in a Bubble?

Now for the bear case. Valuations are stretched.

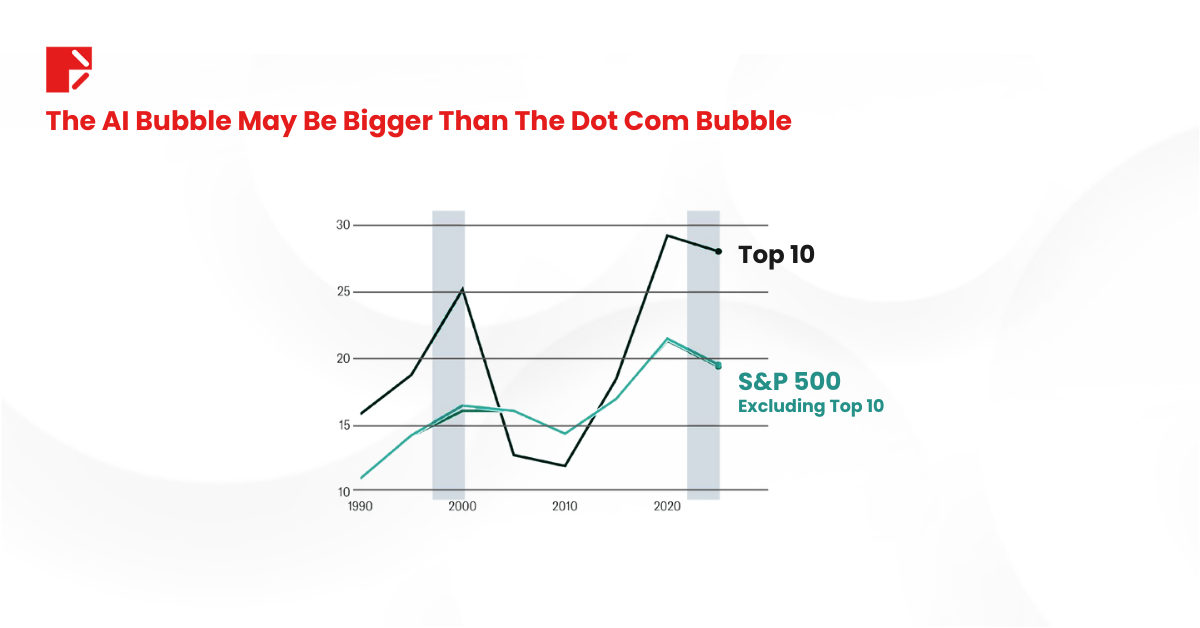

According to data from Apollo and Bloomberg, the top 10 AI-related stocks are trading at higher forward P/E ratios than the dot-com era.

That’s right, this might be the most expensive leadership group we’ve ever seen in U.S. stock market history.

The chart above says it all. Back in 2000, the top IT stocks drove the bubble. In 2025, it’s AI’s turn.

Meanwhile, the rest of the S&P 500 is trading at far more reasonable levels, suggesting this rally is very narrow. It’s driven by a handful of giants, while the average stock is underperforming. That’s a classic red flag when things start to overheat.

So are we in a bubble? The data says maybe but with one major twist…

Nvidia’s $4 Trillion Valuation Says Otherwise

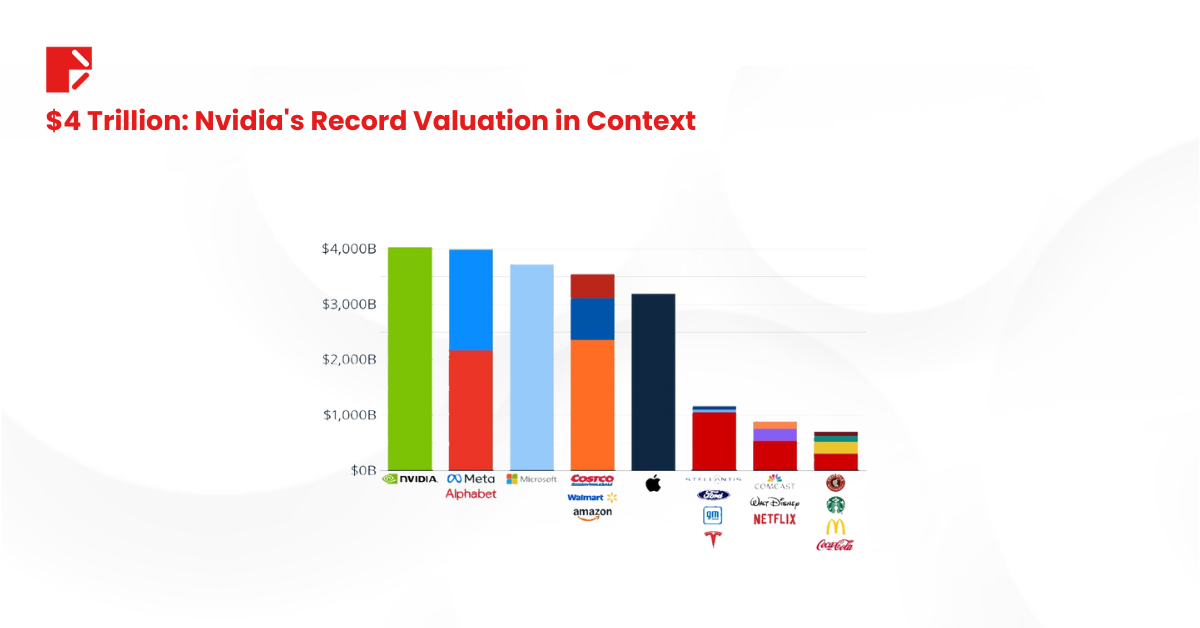

Here’s the twist: Nvidia just hit $4 trillion in market cap. And the market’s still cheering.

Why? Because unlike the dot-com era, Nvidia has actual cash flow, dominant market share, and near-monopoly status in AI chips.

Take a look at this comparison:

Nvidia’s valuation now matches or exceeds the combined market cap of Meta + Alphabet, or Amazon + Walmart + Costco. That’s not an exaggeration; that’s the market assigning generational value to AI infrastructure.

So while the bubble alarm bells are ringing, the fundamental earnings power of these companies is giving bulls a reason to stay long.

Are Traders Rotating Out?

Over the last month, crypto has seen stronger inflows than some big AI names. Energy and materials are starting to show strength. Even biotech is coming back.

That doesn’t mean the AI run is over. But it does mean traders are scanning for new opportunities. When everyone’s already in the trade, risk/reward starts tilting the other way.

Nvidia’s last few moves after earnings have been muted, not because the results weren’t amazing, but because expectations were already sky-high. That’s how momentum starts cooling down. Slowly, then suddenly.

What This Means for Traders

Here’s the smart takeaway: whether or not this is a bubble, the trend is your friend.

The AI revolution is real, even if valuations eventually cool off.

But chasing every spike blindly is where traders get smoked.

Here’s a possible approach:

- Consider the leaders: NVDA, MSFT, AMZN, TSLA.

- Watch for pullbacks to support zones.

- Use earnings reactions as signals: strong earnings + strong reaction = confirmation.

The golden rule is don’t fight the trend, but don’t marry it either.

AI Stocks Overbought or Just Getting Started?

Here’s the honest answer: both.

Yes, AI stocks are overbought in the short term. Valuations are rich, expectations are maxed out, and the easy gains are behind us. If you’re buying here, you’re not early, you’re chasing strength and hoping the momentum holds.

But in the long term, this could still be early. If AI truly changes how businesses run, if it rewires the global labor market, if it becomes the new electricity, then this is just the beginning. And today’s stretched prices might look cheap in hindsight.

Bottom Line: Time to Be Selective

This isn’t 2023 anymore. You can’t just buy anything with “AI” in the name and expect a double.

Now’s the time to get selective:

- Market attention remains high on firms such as Nvidia and Microsoft, which are already reporting real earnings from AI.

- Watch for real adoption metrics, not just flashy demos.

- Use technical pullbacks to build positions, don’t FOMO into every breakout.

The AI trade isn’t over. But from here, it’s about picking your spots and not chasing the crowd.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.