Gold is falling fast. After months of steady gains, the yellow metal is now facing a sharp correction. Traders everywhere are asking the same question: why is gold dropping?

At first glance, it looks like just another commodity pullback. But under the surface, something much bigger is happening, a shift in global liquidity, trust, and monetary behavior.

Let’s unpack what’s really driving gold prices in 2025, why China and central banks are still loading up, and whether the selloff is a short-term panic or part of a deeper cycle.

The 10-Year Gold Story: From Inflation Hedge to Collateral Asset

Over the past decade, the precious metal has transformed from a classic inflation hedge into something entirely different. It became a liquidity anchor for the global financial system.

In inflation-adjusted terms, the price of gold has stayed remarkably resilient since the 2020s. It has survived rising interest rates, strong dollar cycles, and even Bitcoin hype.

But today’s gold price drop is more about liquidity stress than demand.

When investors dump the yellow metal, it’s often to cover margin calls or reposition into cash, not because they’ve lost faith in the metal.

That’s why calling it a “crash” misses the full picture.

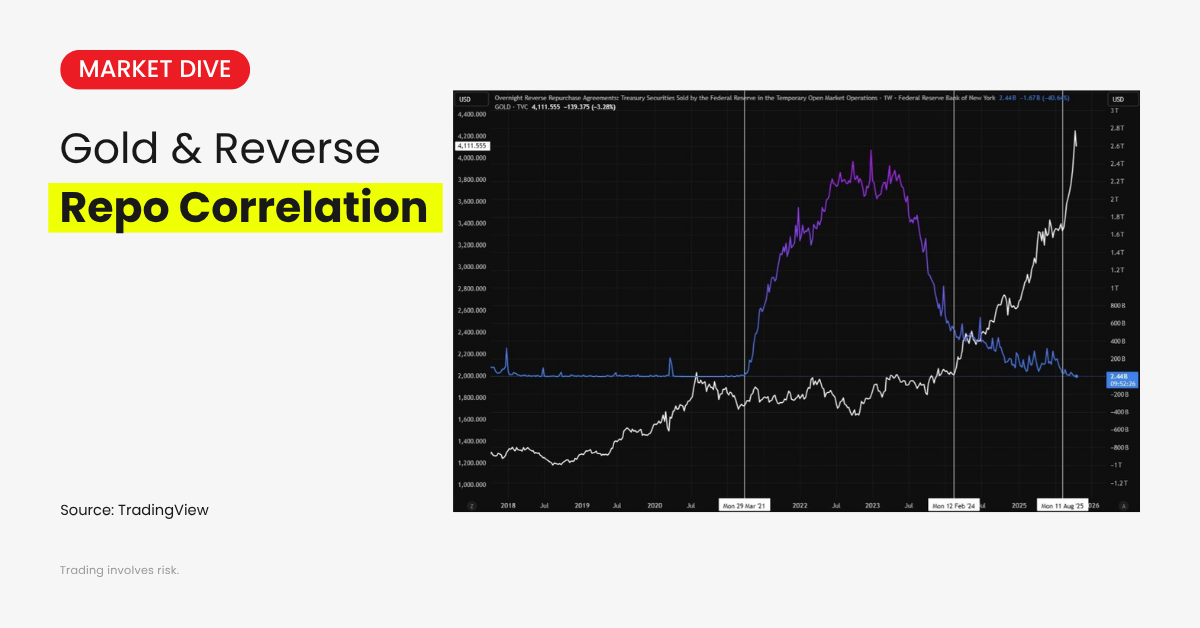

Gold & Fed’s Reverse Repo Outlook

Gold is doing something deeper than just reacting to inflation.

The Fed’s reverse-repo balances started collapsing toward zero. This pool is where banks and funds park excess cash overnight. As liquidity dried up, gold began to ignite

And when those balances nearly vanished, the precious metal went vertical.

Why is this happening? Because when the system runs out of parked liquidity, paper collateral starts cracking, and capital seeks what can’t default, hard money.

Gold is no longer just an inflation hedge. It’s becoming pristine collateral, the asset of last trust.

The world is quietly saying: if the current US dollar system breaks, this is what holds value.

This shift explains why the gold market cap keeps expanding despite short-term corrections.

It’s not about chasing profits anymore, it’s about protecting against a system that’s increasingly fragile.

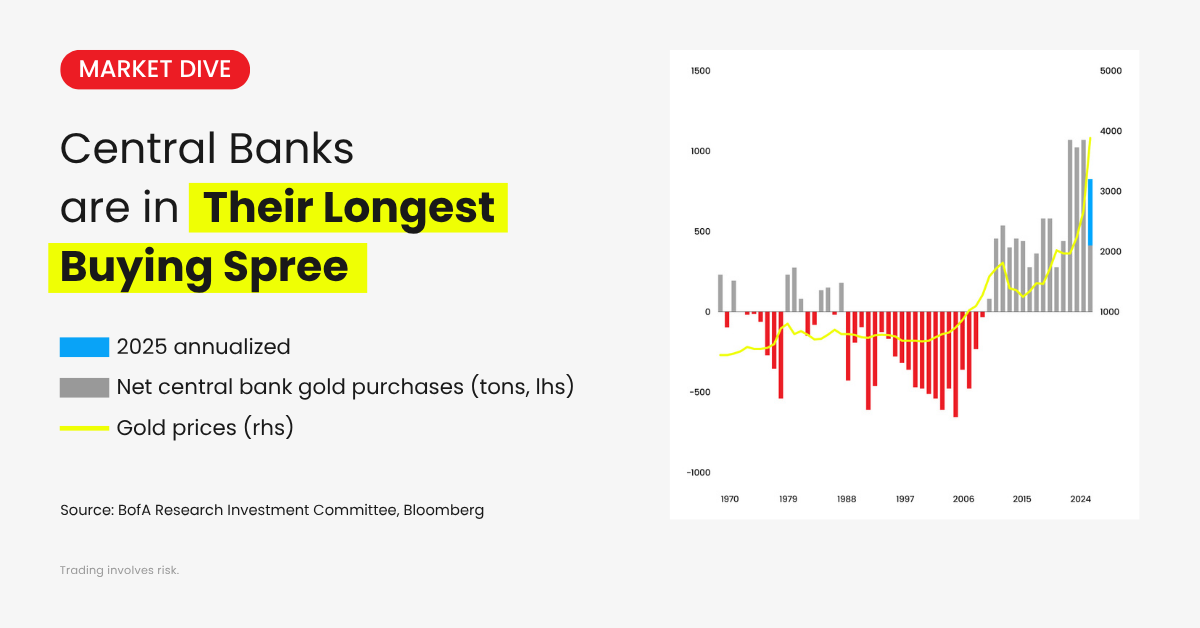

Central Banks are Still Buying the Yellow Metal

While retail traders panic over falling prices, central banks are doing the opposite.

They’re buying gold like never before.

According to the latest data, global central banks have bought an annualized 830 tons of gold in 2025.

In the first half of 2025 alone, 23 countries increased their reserves.

That’s twice the average annual pace seen between 2011 and 2021, and it’s the fourth consecutive year at record-high levels.

Central banks bought 1,080 tons in 2022, 1,051 in 2023, and 1,089 in 2024.

Now 2025 is on track for the 16th straight year of net purchases, the longest streak ever recorded.

Before 2010, central banks had been net sellers of the metal for 21 years.

Today, they can’t stop buying it.

The main reason is because trust in fiat systems is fading.

The yellow metal isn’t anyone’s liability. It doesn’t depend on Washington, Beijing, or the ECB.

When governments diversify reserves, they’re not chasing price, they’re buying insurance.

This is why calling it a gold price crash can be misleading.

Yes, the price of gold is down on the charts, but ownership is quietly changing hands, from traders to treasuries.

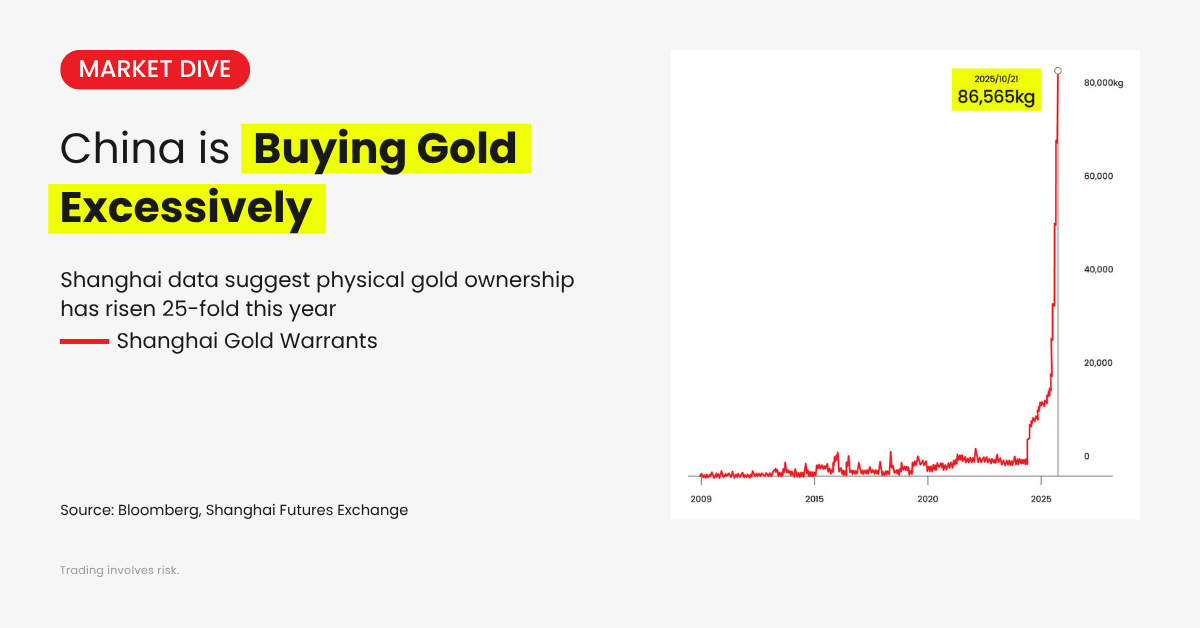

China is Buying Gold Despite Sell-off

If you’re wondering why gold is dropping while demand seems sky-high, look at the short-term flows.

Chinese demand has gone parabolic.

Shanghai gold warrants exploded to a record 86,565 kilograms in October 2025.

That’s a 27-fold jump since 2024, and over 550% higher this year alone.

This is not retail speculation.

This is China stockpiling hard assets amid global de-dollarization trends.

The scale of demand is unlike anything seen before.

While Western traders rotate out of commodities, China is absorbing supply, turning a sell-off into accumulation.

In other words, the current gold price drop could be transient.

What looks like weakness may be a redistribution of ownership across borders.

Gold’s Technical Analysis: What’s Next?

On the technical side, the yellow metal recently hit all-time highs near $4,300 before pulling back below $4,000.

The sharp reversal triggered panic among traders and set off a wave of algorithmic selling.

But this kind of reaction is completely normal after a 30% rally since August.

Markets breathe, even strong trends need to cool off before the next move.

As long as gold holds above the $3,400–$3,500 zone, the broader structure still supports long-term stability.

Volatility spikes like this are normal during macro stress.

Each dip since 2018, trade wars, pandemic panic, rate shocks, has eventually turned into a new base before the next leg higher.

That’s why traders watching the gold price forecast for the next 5 years aren’t rushing to call an end to the bull cycle just yet.

The New Role of Gold in the Global System

Gold’s story in 2025 is no longer about jewelry or inflation.

It’s about trust, collateral, and survival.

When you adjust for global inflation, the inflation-adjusted gold price still shows remarkable strength.

Even during recessions, the metal often performs as a stabilizer, making it one of the few inflation-proof investments left in the global market.

As capital rotates out of risky assets, the question is not how much is a ton of gold worth. It’s how much trust does that ton represent?

From the gold price in 1980 to the gold price 2030 forecasts, one truth remains. every time monetary trust breaks, the precious metal re-prices itself higher in real terms.

Will Gold Prices Recover?

Short answer: gold doesn’t need to “recover”. The world does.

Every time liquidity tightens, the precious metal becomes the mirror reflecting it.

When paper assets wobble, the yellow metal shines. Sometimes quietly and sometimes violently.

That’s why the question isn’t why is gold going up or down, but what is gold signaling this time?

Whether you’re watching China’s gold holdings, central bank reserves, or commodity gold flows, the pattern is the same: when confidence fades, accumulation begins.

So yes, the yellow metal may be dropping on the chart.

But beneath it, a new global foundation of trust is being built, one bar at a time.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.